A Look at Key Commodities Impacting Agriculture and Energy. Surging USD --- Wholesale Beef Strong --- Nat Gas Bottoming? --- Diesel Sliding Demand

DOLLAR RALLY: Here’s a look at the U.S. dollar over the past month. The USD is in a steady recovery driven due to a deepening recession in Europe and Asia. The dollar is gaining ground at the same time gold prices at testing record highs. This is rare. USD safe-haven investor buying is certainty apart of the recent dollar climb. But the rise in the dollar does make U.S. exports less competitive. USD TREND REMAINS UP.

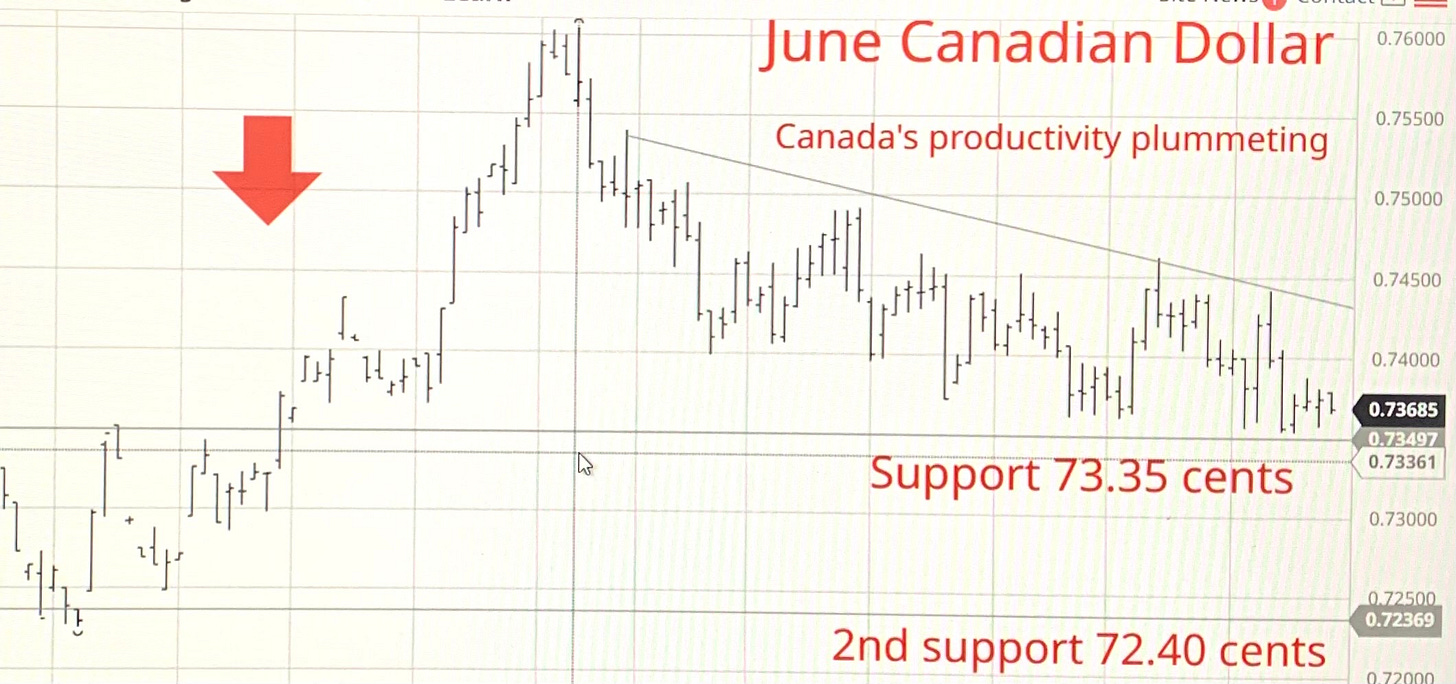

LOONIE DRIFTING LOWER: The Cdn dollar remains in a gradual downtrend. Canada’s fading economic productivity is a cause-of-concern. Certainly, the incoming April 1st carbon tax is yet another dagger to economic prosperity. Here’s a look at the June loonie over the past six (6) months (since October). Technically, the June CAD contract has chart support approaching at 73.50 cents U.S. This may be which tested shortly. The next step lower support is seen at 72.40 cents U.S. (SEE CHART). HEDGERS NOTE: CANADIAN DOLLAR TREND REMAINS DOWN.

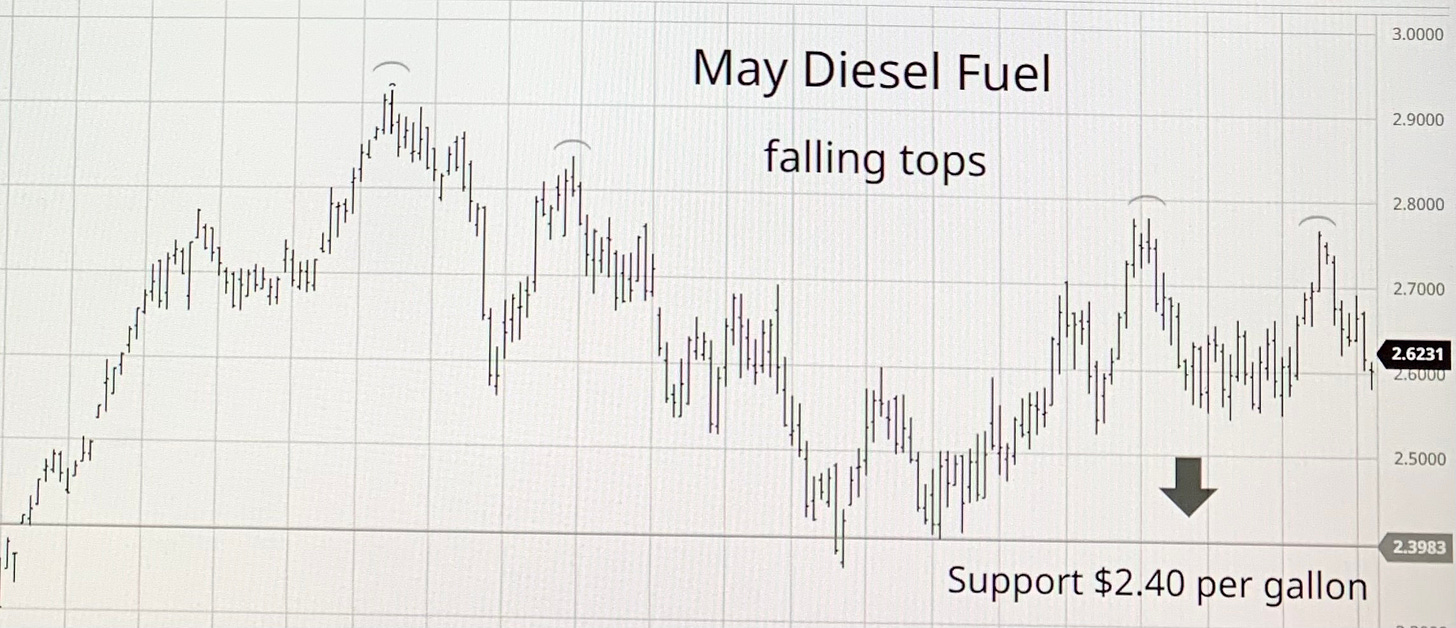

CRUDE OIL HEDGERS NOTE: Crude oil is now testing the top end of its current trading range. Here’s a six (6) month view of May WTI oil. Geopolitical tensions across the Middle East continue to be key support. May WTI testing $83 per barrel is seen as significant resistance. On a pullback, oil prices are technically at-risk of a $5 per barrel pullback. CRUDE OIL PRICES MAY BE AT-RISK OF A $5 PER BARREL PULLBACK THIS SPRING. Oil chart trend now considered toppy. Note: Diesel futures continue to struggle.

CATTLE MARKET UPDATE: Alberta direct cattle sales this week saw dressed sales reported $10/cwt higher than last week at 400/cwt delivered. This is reflecting about a $20/cwt climb over the past six (6) weeks. Cattle contracted have quick lift times only two (2) weeks out for movement. Basis levels are strengthening, a reflection of stiffening demand between Alberta and US packers. ALBERTA FED CATTLE BASIS LEVELS STRENGTHENING. Alberta fat bids are now at a nine (9) month high. Note: Alberta fed prices are now par with the Ontario market. STRATEGY FOR STRONG FUTURES + STRONG BASIS = FLAT PRICE YOUR CATTLE.

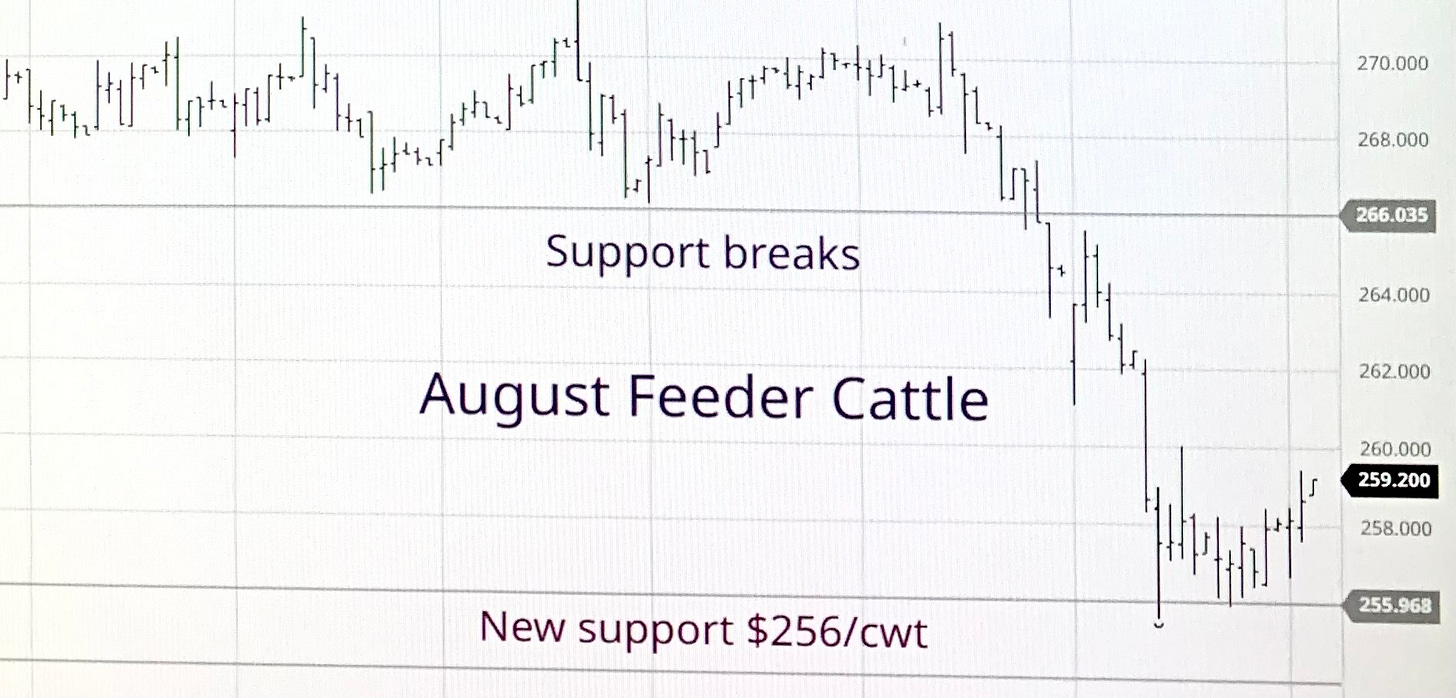

Hedgers note: The cattle board took a spill this week with USDA reporting record February feedlot placements. Feeder cattle futures have broke into a lower trading range. Maintain your price protection. It’s tempting to take a profit, but wholesale beef prices could break by late spring. WHOLESALE BEEF PRICES COULD BREAK BY LATE SPRING. Hold your hedges . . . .

Stateside, Texas and Kansas cash cattle broke $3/cwt lower this week averaging 185/cwt. Nebraska dressed sales are $4/cwt this week. Beef cow slaughter is down about 10% this week, the lightest slaughter in five (5) years. COW PRICES REMAIN STRONG.

WHEAT MARKET UPDATE: Chart technicals now quite interesting. Kansas City wheat now threatening to break its long-term downtrend. July Kansas City plunged to a low approaching $5.40/bu. Now July KC is attempting to challenge $6/bu. Technically, a break above $6/bu suggest a possible move toward $6.35/bu (SEE CHART). Global wheat markets are oversold. Discounted Russian wheat has been the dominant force dictating global export prices. Now the market will again focus on planting progress and weather across key U.S. / Cdn growing regions.

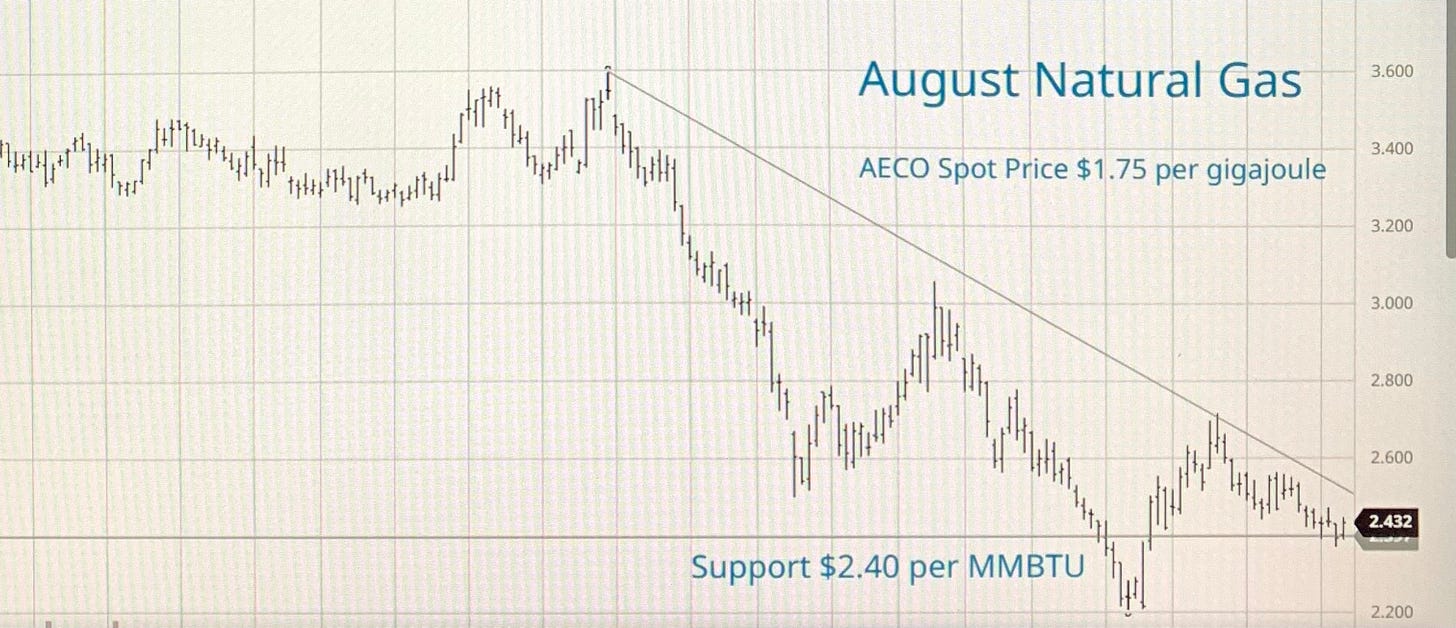

NATURAL GAS UPDATE: North American and European gas market remains flooded with supply. The AECO storage hub price in southeastern Alberta (Suffield) now ranges $1.70 to $1.75 per gigajoule. This reflects a further 25 to 30 cent per gigajoule decline in spot Alberta gas prices since early March. Warm winter temps stateside and in Europe is the reason for the storage build. But air conditioning season is now right around-the-corner. This should finally place a floor under the spot nat gas market.. AIR CONDITIONING SEASON AROUND-THE-CORNER / IMPROVED NAT GAS DEMAND SEEN AHEAD.

Here’s a look at August natural gas futures over the past nine (9) months. Natural Gas Users / Hedgers: Consider call options for nat gas price protection heading toward the fall market. Avoid futures positions outright as the natural gas futures contract is enormous. This can lead to massive margin call risk. Call option purchase; you are only exposed to the premium value, no more. There is no margin call risk.

Diesel fuel prices are actually in-decline. Canada’s carbon tax hike April 1st distorting the actual weakness in the overall diesel market. Subscribers note: The U.S. is in recession despite the government denial. Canada’s recession now nearly one (1) year old is worsening. As a result, diesel fuel demand will continue to slow. DIESEL FUEL DEMAND WILL CONTINUE TO SLOW. Proof-in-the-pudding . . . Just ask any trucker if there is a recession or not. They know, Trucking industry is the first to know there is a downturn. Stay tuned to Errol’s Commodity Wire . . . .

For those on a free trial, please subscribe. Markets are fascinating and lots of ongoing action. This report will try to keep-up with the pace and highlight strategies for the dips and turns ahead. Note: A voice broadcast is available for these reports. Just hit that play button. HAPPY EASTER EVERYONE!