Lower Canola / Soyoil Trading Window . . . .

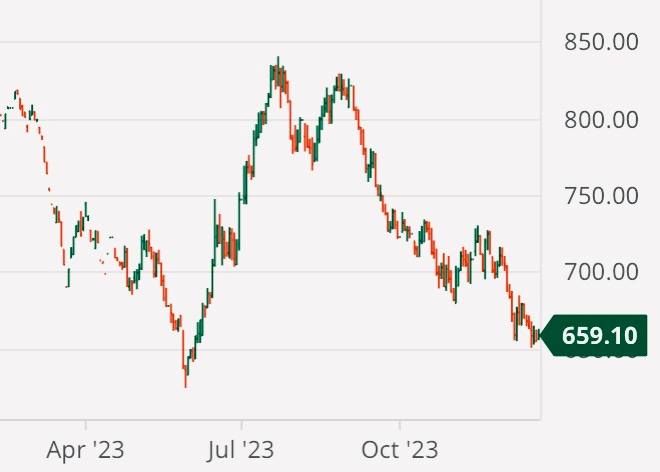

A LOOK AT CANOLA: $4/BU DECLINE OR 22% FUTURES PULLBACK SINCE MID SUMMER. GLOBAL VEG OIL MARKETS REMAIN UNDER PRESSURE.

Since mid-summer futures highs breaching $840/MT, nearby canola contracts now sliding below $660/MT, a 22% pullback. Technically, canola trend remains down following weakened global vegetable oil market. The current trading window for March canola; resistance at $680/MT. Major support seen at $600/MT. Key watch also impacting veg oil markets are crude oil and corn.

Corn futures tested fresh contract lows this week. Corn technically weak, major long-term support seen at $4/bu (without fresh bullish news). This may be a stretch, but nonetheless possible in 1st quarter 2024.

Crude oil supported by Black Sea drone attacks this week, overall global oil price trend remains. Again, sell the rallies as they occur. Global economies now too weak to support prolong price gains.

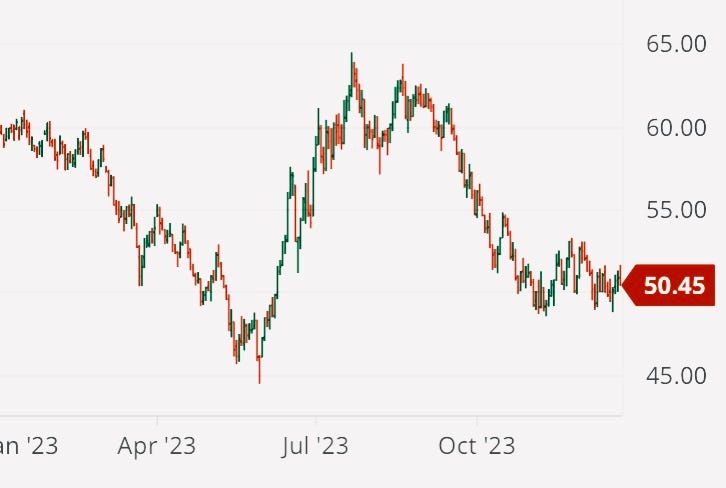

A LOOK AT SOYOIL, 22% SLIDE FROM SUMMER HIGHS. EXPORTS SLOW. CRUDE OIL PULLBACK PRESSURES BIO-DIESEL MARKET

Major nearby major chart support for March soyoil seen approaching 45 cents/lb. Heavy resistance seen at 53 cents/lb. Producers, stay price protected via short hedges / put options. PRODUCERS; KEEP YOUR PRICE PROTECTION GUARD UP. Best case scenario is watching put options (price protection) expire worthless, but that isn’t the case right now. Keep an eye on crude as oil price direction impacts soyoil / bio-diesel market. All the best in your marketing . . . . Errol