U.S. Tariffs Pressure Commodity Prices - - - Nat Gas Price Drop - - - Cryptos Uneasy - - - Flax Bids Up, Up - - - Canola Uneasy

Monday, Monday . . . . Global blowback appears rapidly intensifying from White House / Ukraine spat. Also U.S. stock market seen weak-kneed as economy clearly stumbling. Apparently, U.S. now losing global contract deals. Tesla fallout. Cryptos remains under-fire despite administration rescue attempt today. This is a watch . . . .

Commodities are nauseous on tariff trade disruptions. Global trade patterns are now in-flux . . . .

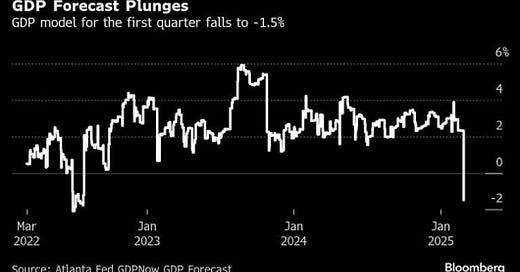

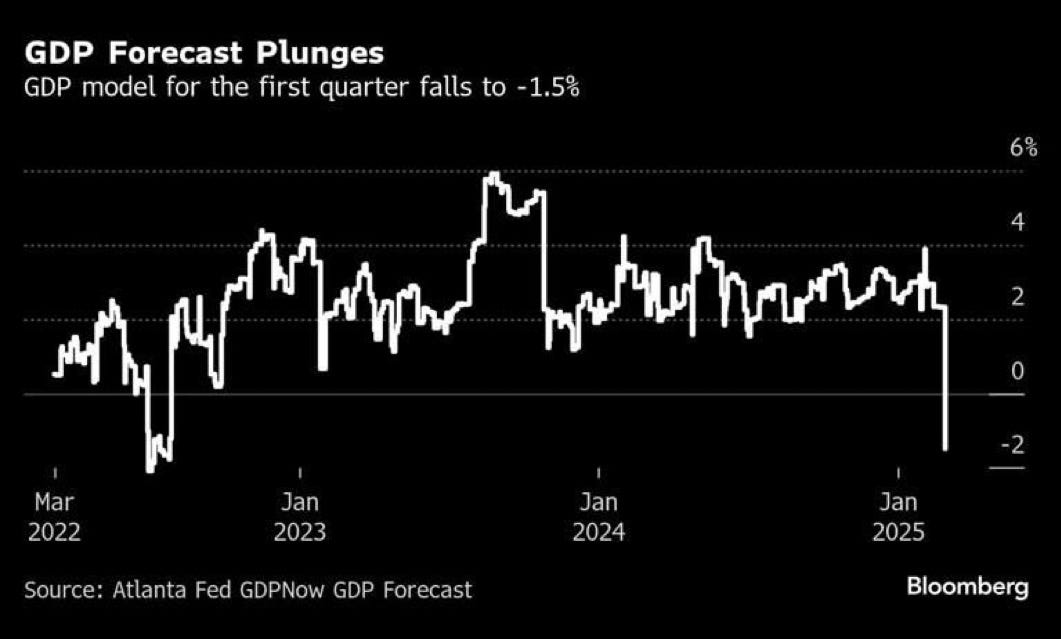

Trump has confirmed, Canada, Mexico and China tariffs are a-go for tomorrow. But the U.S. is also experiencing significant economic blowback from tariff / trade disruptions. Here’s a quick visual snapshot of what’s happening to the U.S. economy right now . . .

U.S. GDP In Sharp Contraction

U.S. Unemployment Soars

Will this economic downturn have any impact on the longevity of U.S. tariffs? It may . . . . Lets take a look at what the U.S. economic slowdown is doing to the global commodity market, including gasoline, soymeal, natural gas and lean hogs.

Plus lets take a look at the current flax market and canola price trends and factors including some strategies to consider . . . .

Keep reading with a 7-day free trial

Subscribe to Errol’s Commodity Wire to keep reading this post and get 7 days of free access to the full post archives.